Foreclosure Timeline and Alternatives

For owner-occupied loans from 2003 to 2007, a lender initiating the foreclosure process must generally contact the borrower by phone or in-person to assess the borrower´s financial situation and explore options for avoiding foreclosure. During the conversation, the lender must inform the borrower of the right to meet with the lender within 14 days. The lender must also give the borrower the toll-free number for finding a HUD-certified housing counseling agency.

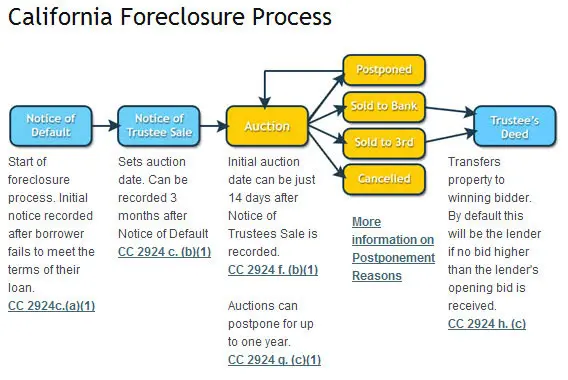

For owner-occupied loans from 2003 to 2007, the lender may file a notice of default 30 days after contacting the borrower to explore options for avoiding foreclosure. The notice of default must be filed in the county where the property is located and a copy must be mailed within 10 business days after recordation to the borrower and all other persons who have requested such notice. The notice of default informs the borrower of the default. It must also include the lender´s declaration that it has contacted the borrower to explore options for avoiding foreclosure, tried with due diligence to contact the borrower, or the borrower has surrendered the property.

Three months after the filing of the notice of default, the lender may record a notice of trustee´s sale setting forth the date, time, and place of the upcoming trustee´s sale. Because of the gravity of a notice of trustee´s sale, it must be widely disseminated. The notice of trustee´s sale must be recorded, posted, mailed to the borrower and others, as well as published once a week for three consecutive weeks in a newspaper of general circulation.

Up to five business days before the trustee´s sale, the borrower may reinstate the loan by curing the default or paying the missed payments plus allowable costs. After the reinstatement period expires, the borrower still has the right to redeem the property by paying the entire debt, plus interest and costs (not just the arrearage), before the bidding begins at the trustee´s sale.

Although California law allows a trustee´s sale to take place 20 days after the posting of the notice of trustee´s sale, lenders customarily wait at least 31 days instead to help protect against federal tax liens. At the trustee´s sale, the property is sold through a public auction to the highest bidder. Title is transferred to the successful bidder by the trustee´s deed. The lender can also elect to take the property back as an REO (which stands for Real Estate Owned by the bank). They do this by purposely starting the bidding above market value. In this case, the property will eventually go on the market as a bank-owned foreclosure.

Source – California Association of Realtors

Finally, it is often possible to get a foreclosure sale date postponed as long as an offer has been submitted to the bank and the borrower is moving forward with the short sale process. If you have currently had a NOD or NOTS filed on your property, you still have time to do a short sale, but you need to move quickly. A realtor experienced in short sales can generate an offer quickly and get it submitted to your lender and postpone the sale date.